15 Helpful Financial Tips for Small Businesses

The economy, in any part of the world, embarks on diversity and change. Thus, starting a small business is a significant risk to take, not to mention growing and maintaining one. Most startups make do of the resources they have and try to make the best of it. Many would bank on a product or on an idea. However, the most successful of them all possess a very basic tool in business – financial acumen. From a finance expert’s point of view, here are some helpful financial tips that will lead your business to the path of our success.

1. Even Champions Need a Coach

Even the champions, the greatest fighters and the best athletes need a coach to win a fight. Same goes when venturing for a small business. You will need a business coach that will help you think like the entrepreneur you’re aiming to be. Your coach or mentor can share with you amazing ideas and help you avoid the trial and error learning that can add up to your expenses.

Photo by rawpixel.com from Pexels

2. Find your Passion

Find your passion and make it your business. As the proverb goes, “Love your work, and you will never work a day.” Find something you love, then work and business will be a source of inspiration and satisfaction for you. It will also be something that you know a lot about. At times of stressful situations, your passion will keep you moving forward, avoiding bad decisions and wasting money already invested.

Photo by rawpixel.com from Pexels

3. Plan Ahead

As Benjamin Franklin said, “By failing to prepare, you are preparing to fail.” Preparation is an essential step in the success of your business. This is where you’ll consider all the possibilities. Estimate your expenses, income, loans you may need to apply for and possible setbacks. And from there, create plans A, B to Z with the help of your business coach. Remember, it will be very hard to defeat a warrior who’s always ready for the battle.

Photo by JESHOOTS.com from Pexels

4. Create your Budget Frame

A general mistake a lot of entrepreneurs commit is creating an exact budget based on their needs which, later on, catches them off-guard when unexpected costs appear in the middle of the year. To avoid this, either allot more than expected expenses or have a fund allotted for unexpected outlays. This will prove useful especially when confronted with sudden, urgent and unexpected expenses like equipment repairs or material price increases.

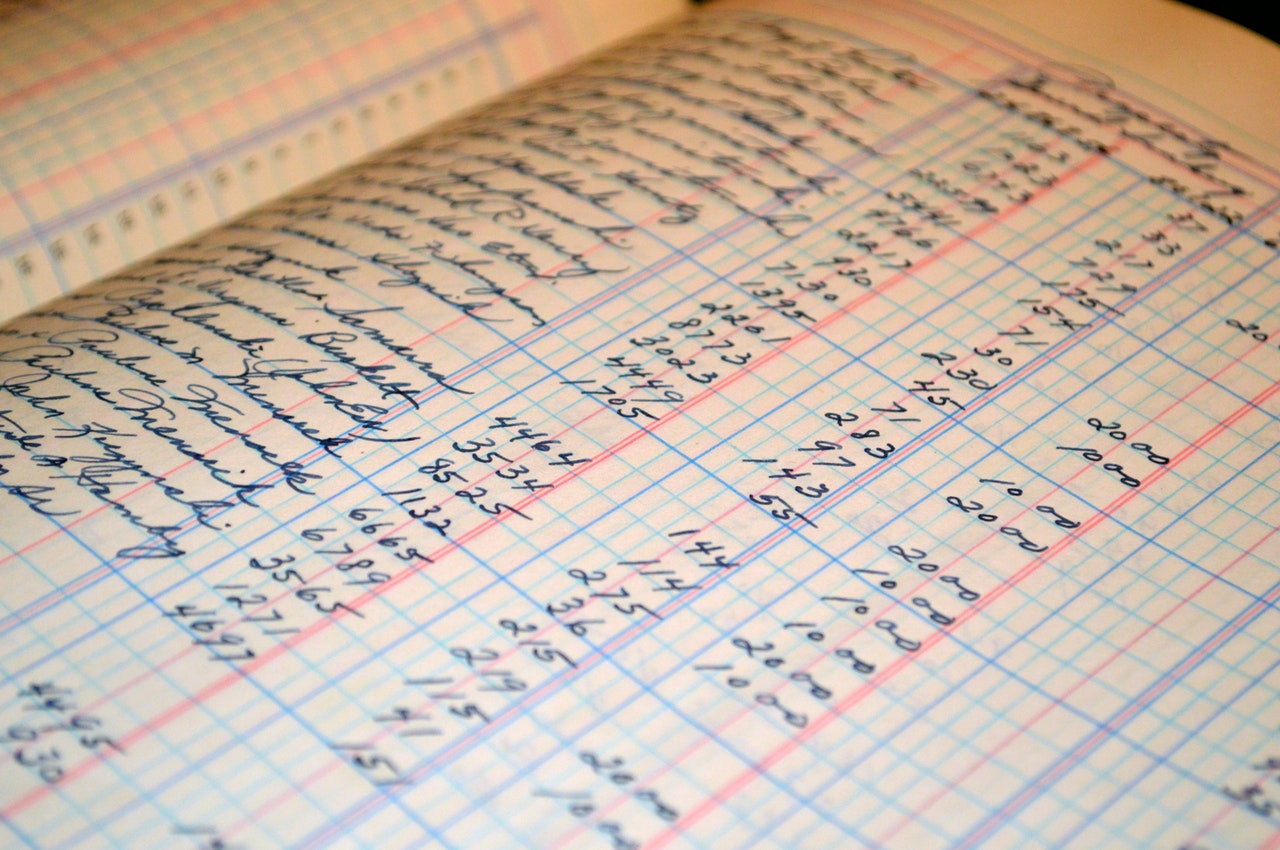

5. Be a Diligent Recorder

Managing your expenses is vital in keeping the business moving. Your expenses can make or break your income growth. Record what was purchased, when was it purchased and even who purchased it. Account all the invoices and payments. This will help you keep track of your cash flow and easily point out irregularities as well as opportunities to save money.

6. Separate Personal and Business Expenses

Another tip that you’ll find useful is to account for your personal and business separately. This will simplify accounting and give you a better perspective of your personal income and expenses. Some business owners deprive themselves of a salary. But you have to understand that it is important for your business to have a firm structure of salary and expenses from top to bottom, and that includes YOU.

Photo by bruce mars from Pexels

7. Know your Cash Flow

Pinpoint the season that your business earns the most and the season when the income is at its lowest. Also, identify when you the business have the highest and lowest cash outlay. Then, create a plan on how you can keep your business liquid and avoid running out cash to pay expenses and other business obligations as they mature.

8. Time is Money

Timeliness applies to your goals. To be financially successful, you must set a time frame for your targets. Say, a year from now, you should have gained your capital back, then three years from now you should be able to upgrade your equipment and come five years, your business will be ready for expansion. Remember, time spent wisely translates to income earned timely.

9. Take Control of Your Loans

In the years of managing a business, there will be a time when the road is going to be a bit patchy and rough. And it is imperative that you, as the business owner, knows when it is best to apply for a loan. Borrowing money along with the interest rates are tricky. Always review the terms and conditions of the loan and assess whether your company can meet the terms or not. Never get a loan that you don’t need.

10. Involve your Team

One surprising business financial tip is to involve your employees. They are, after all, the core of your business. Letting them in on the financial status and details of the business will give them a better viewpoint of what’s happening to the company. This will encourage ideas, insights and other inputs from them. Knowing the bigger picture of the business will also reduce unnecessary expenses, proactive savings and contributions from the team.

Photo by rawpixel.com from Pexels

11. Spend Wisely

Don’t always go for the priciest equipment or properties to purchase. If the price is way out of the budget, consider leasing instead. This will save you the cost of repair and if you consider renting, you can always move out in case you need a bigger place for expansion. Quality does not always come with additional expenses.

12. Revisit the Budget

After the first six months, revisit your budget to check if you are still on track of the goals you set at the start of the year. Make this a habit. Revisiting will let you picture how your business will be in the next six months, one year or five years, and will let you know if you need to adjust the numbers.

Photo by Lukas from Pexels

13. Expansion

Growth and expansion are always in the plans of any business startup. However, a very common mistake most entrepreneurs commit is allotting most of the business’ finances towards expansion. You must keep in mind that expanding your business is another risk you are going to take. So, plan it carefully. List everything that you need, set the right budget and find alternative funding.

Photo by rawpixel.com from Pexels

14. Manage your Payments

Business comes with regular cash expenditures to cover overhead and payables along with other expenses. Keeping up with your expenses and payables is highly encouraged. You do not only save on interest charges, you could also earn credits and discounts. Suppliers also favour good payors; thus, you get quality items, premium terms and other discounts.

Photo by rawpixel.com from Pexels

15. Be Technologically Updated

Why not use technology to your advantage and go electronically? Make digital copies and store all your legal documents in a computer. It is safer and cheaper than the traditional filing cabinet system. Going paperless will cut your stationery expenditures to half. Instead of setting up, maintaining and using expensive multiple-room offices, opt for the more technologically advanced virtual staffing, online meetings and workspaces and clouding.

Photo by rawpixel.com from Pexels

General advice disclaimer

The information provided on this website is a brief overview and is general in nature. It does not constitute any type of advice. We endeavour to ensure that the information provided is accurate however information may become outdated as legislation, policies, regulations and other considerations constantly change. Individuals must not rely on this information to make a financial, investment or legal decision. Please consult with an appropriate professional before making any decision.